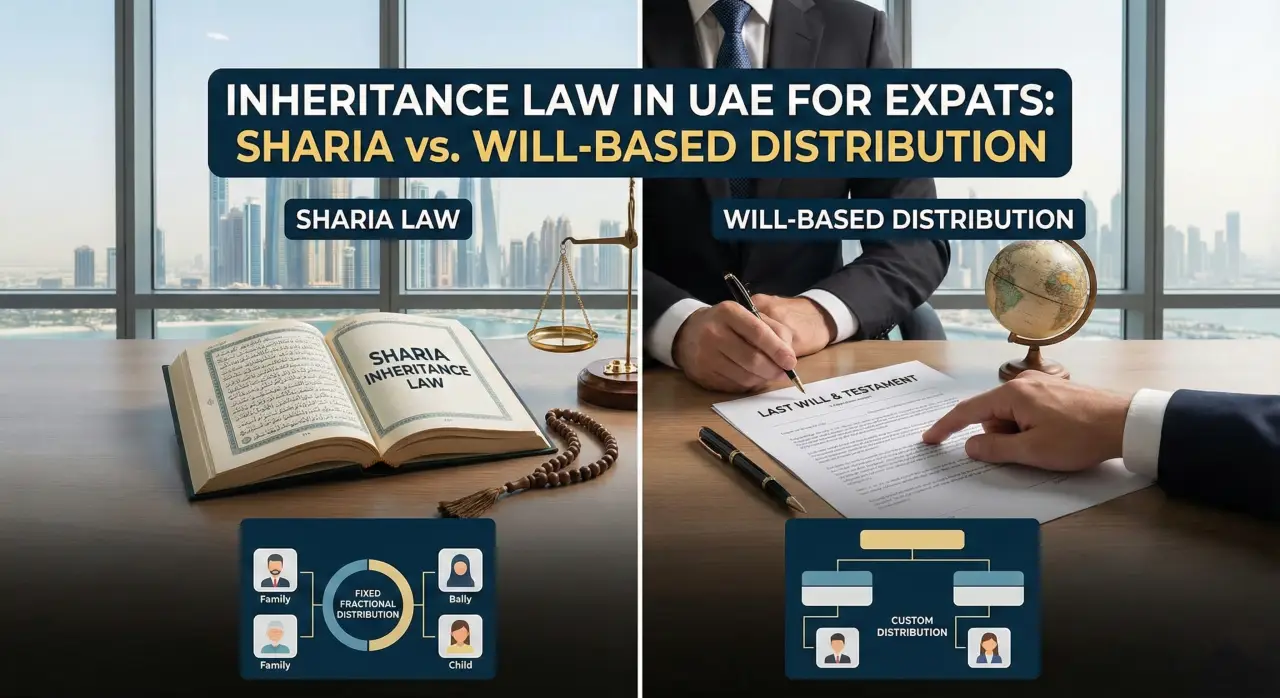

Inheritance Law in UAE for Expats: Sharia Law Distribution vs Will-Based Distribution

Inheritance law in the UAE works very differently from most Western legal systems. For expatriates, this often comes as a surprise, particularly when they discover that Sharia law may apply to their estate even if they are not Muslim.

Many families only learn this after a death has already occurred, when bank accounts are frozen and courts begin applying rules that the deceased never intended.

This article will explain:

- How inheritance law works for expats in the UAE

- The difference between Sharia-based inheritance and will-based inheritance

- How expats can legally control who receives their assets

- Why writing a UAE-registered will is critical

Does Sharia Law Apply to Expats in the UAE?

Yes.

If a person dies in the UAE without a registered will, UAE courts distribute their assets under UAE Personal Status Law, which is derived from Sharia principles.

This applies regardless of:

- Religion

- Nationality

- Residency status

Any assets located inside the UAE. such as property, bank accounts, or investments, fall under this system.

How Sharia Inheritance Works

Under Sharia law, inheritance is divided using fixed legal formulas.

These rules determine:

- Who qualifies as an heir

- What percentage each heir receives

- Whether gender affects entitlement

A simplified example:

| Heir | Typical Share |

| Wife | 1/8 if there are children |

| Husband | 1/4 if there are children |

| Sons | Double the share of daughters |

| Parents | Fixed legal portions |

| Other relatives | May be entitled |

This means a surviving spouse does not automatically inherit the full estate, and children inherit in predefined proportions.

Parents and extended family may have legal rights.

For many expat families, this outcome is very different from what they expect or intend.

What Happens If an Expat Dies Without a Will in the UAE?

If an expat dies intestate (without a will):

The UAE courts freeze bank accounts

Property cannot be sold or transferred

Guardianship of children is determined by the court

Heirs must be identified under Sharia law

A court-appointed expert distributes the estate

This process can take months or years, leaving families without access to money or property.

How Does a Will Differ From Sharia Inheritance Law for Expats?

UAE law allows non-Muslim expats to override Sharia inheritance rules by registering a legally valid will.

A registered will allows you to:

- Choose who inherits your assets

- Decide how your estate is divided

- Appoint guardians for children

- Prevent forced asset sharing

- Protect a spouse from unintended outcomes

Once properly registered, the will becomes legally binding on UAE courts.

Types of Wills in the UAE

DIFC Wills and probate Registry

DIFC wills are widely used by expats because they:

- Follow common-law principles

- Are written in English

- Allow full asset distribution freedom

- Are recognized by UAE courts

They can cover:

- UAE property

- Bank accounts

- Investments

- Worldwide assets (optional)

- Guardianship

Abu Dhabi Non-Muslim Wills

Abu Dhabi allows non-Muslims to register civil wills that:

- Exclude Sharia inheritance

- Permit full control over asset distribution

Dubai Courts Non-Muslim Wills

These wills are registered through Dubai Courts and provide:

- Formal inheritance instructions

- Legal protection against default Sharia rules

Which Assets Should Be Covered in a UAE Will?

A properly drafted will should include:

UAE real estate

Bank accounts

Investments

Business shares

Vehicles

Personal belongings

Guardianship of children

If assets are not included, they may still fall under Sharia distribution.

Why Expats Should Not Rely on Their Home Country Will

Foreign wills are often:

Not automatically enforceable in UAE courts

Subject to translation and legalization

Challenged by heirs

Delayed by procedural law

A UAE-registered will avoids these risks and ensures immediate recognition by local courts.

What Happens to Children Without a Will?

Without a will:

Guardianship does not automatically go to the surviving parent

UAE courts appoint temporary guardians

Children may be placed under state supervision

A registered will allows parents to legally nominate guardians and avoid uncertainty.

Why Does Professional Legal Drafting Matter?

If a will is

- Incorrectly drafted

- Poorly registered

- Missing required clauses

It may not override Sharia law at all.

This is why wills and inheritance planning in the UAE are usually handled by UAE family lawyers who understand both local and international legal systems.

A poorly written or incorrectly registered will may:

Be rejected by courts

Fail to override Sharia

Lead to disputes between heirs

Cause asset freezing

An experienced UAE inheritance lawyer ensures:

Correct legal structure

Proper registration

Asset coverage

Court enforceability

FAQ (Frequently Asked Questions)

Does Sharia law apply to non-Muslims in the UAE?

Yes. If a non-Muslim expat dies without a registered will, UAE courts apply Sharia-based inheritance rules to their UAE assets.

Can expats avoid Sharia inheritance in the UAE?

Yes. Non-Muslim expats can register a legally valid will with DIFC, Abu Dhabi courts, or Dubai courts to override Sharia distribution.

What happens to bank accounts when someone dies in the UAE?

All UAE bank accounts are frozen until inheritance proceedings are completed or a registered will is executed.

Does a foreign will work in the UAE?

A foreign will may be accepted, but it often requires translation, attestation, and court approval, which causes delays and legal risk.

Who gets custody of children if there is no will?

UAE courts decide guardianship if no will exists, even if one parent is still alive.

Is a UAE will legally binding?

Yes. When properly registered, a UAE will is enforceable by local courts and overrides default inheritance rules.

Do DIFC wills cover assets outside the UAE?

Yes. DIFC wills can be drafted to include worldwide assets if requested.